As filed with the Securities and Exchange Commission on June 30, 2025.

Registration Statement No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________

FORM

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

_____________________________________

(Exact Name of Registrant as Specified in its Constitution)

Not Applicable

(Translation of Registrant name into English)

_____________________________________

| | 2834 | N/A | ||

| (State or Other Jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

100 Albert Road

Australia

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

_____________________________________

Tel:

(Name, address, including zip code, and telephone number, including area code, of agent for service)

_____________________________________

With copies to:

|

Richard I. Anslow, Esq. |

Clayton E. Parker, Esq. |

_____________________________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after effectiveness of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised accounting standards† provided to Section 7(a)(2)(B) of the Securities Act.

____________

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS |

SUBJECT TO COMPLETION, DATED JUNE 30, 2025 |

Up to 4,000,000 Ordinary Shares

Gelteq Limited

This prospectus relates to the resale, from time to time, of up to 4,000,000 of our ordinary shares, no par value (the “Ordinary Shares”), by the selling shareholder, Lincoln Park Capital Fund, LLC (“Lincoln Park”, or the “selling shareholder”).

The Ordinary Shares being offered by the selling shareholder have been or may be issued pursuant to that certain purchase agreement between us and Lincoln Park, dated as of March 13, 2025 (the “Purchase Agreement”). See “The Lincoln Park Transaction” for a description of the Purchase Agreement and “Selling Shareholder” for additional information regarding Lincoln Park. The prices at which Lincoln Park may sell the shares will be determined by the prevailing market price for the shares or in negotiated transactions.

We may receive gross proceeds of up to $12,000,000 from the sale of our Ordinary Shares (“Purchase Shares”) to Lincoln Park under the Purchase Agreement, from time to time, in our discretion after the date of the registration statement of which this prospectus is a part is declared effective and after satisfaction of other conditions in the Purchase Agreement. We are not selling any securities under this prospectus and will not receive any of the proceeds from the sale of the shares by the selling shareholder.

Lincoln Park may sell the Ordinary Shares described in this prospectus in a number of different ways and at varying prices. The price that Lincoln Park will pay for the shares to be resold pursuant to this prospectus will depend upon the timing of sales and will fluctuate based on the trading price of our Ordinary Shares. Lincoln Park is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended (the “Securities Act”).

The purchase price for the Purchase Shares will be based upon formulas set forth in the Purchase Agreement depending on the type of purchase notice we submit to Lincoln Park from time to time. We will pay the expenses incurred in registering the Ordinary Shares, including legal and accounting fees. See “Plan of Distribution” on page 80 for more information about how Lincoln Park may sell the Ordinary Shares being registered pursuant to this prospectus.

We previously closed our initial public offering (“IPO”) on October 30, 2024. Our Ordinary Shares are listed on the Nasdaq Capital Market (“Nasdaq”) under the symbol “GELS.” On June 27, 2025, the closing price of our Ordinary Shares was $1.81 per share.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings.

Investing in our Ordinary Shares involves a high degree of risk. See “Risk Factors” beginning on page 8 for a discussion of information that should be considered in connection with an investment in our Ordinary Shares.

Neither the Securities and Exchange Commission nor any other state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2025.

TABLE OF CONTENTS

|

Page |

||

|

ii |

||

|

iii |

||

|

iv |

||

|

vi |

||

|

1 |

||

|

5 |

||

|

8 |

||

|

16 |

||

|

17 |

||

|

22 |

||

|

23 |

||

|

MANAGEMENT DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

24 |

|

|

43 |

||

|

69 |

||

|

75 |

||

|

76 |

||

|

77 |

||

|

78 |

||

|

80 |

||

|

82 |

||

|

83 |

||

|

83 |

||

|

83 |

||

|

84 |

You should rely only on the information contained or incorporated by reference in this prospectus or in any related free-writing prospectus. Neither we nor the selling shareholder has authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses prepared by us or on our behalf or to which we have referred you. We take no responsibility for and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the Ordinary Shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted or where the person making the offer or sale is not qualified to do so or to any person to whom it is not permitted to make such offer or sale. We have not taken any action to permit a public offering of the Ordinary Shares outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of the Ordinary Shares and the distribution of the prospectus outside the United States. The information contained in this prospectus is current only as of the date on the front cover of the prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

We are incorporated as an Australian public limited company limited to shares under the laws of Australia pursuant to our constitution, and a majority of our outstanding securities are owned by non-U.S. residents. Under the rules of the U.S. Securities and Exchange Commission, or SEC, we are currently eligible for treatment as a “foreign private issuer,” or FPI. As an FPI, we are not required to file periodic reports and financial statements with the SEC as frequently or as promptly as domestic registrants whose securities are registered under the Securities Exchange Act of 1934, as amended, or the Exchange Act.

Until , 2025 (the 25th day after the date of this prospectus), all dealers that buy, sell or trade Ordinary Shares, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

i

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form F-1 filed with the SEC by Gelteq Limited, an Australian public limited company limited to shares pursuant to its Constitution. This prospectus includes important information about us, the Ordinary Shares and other information you should know before investing in the Ordinary Shares. This prospectus does not contain all of the information provided in the registration statement that we filed with the SEC. You should read this prospectus together with the additional information about us described in the section below entitled “Where You Can Find Additional Information.”

For investors outside of the United States of America (the “United States” or the “U.S.”): Neither we nor the selling shareholder have done anything to permit the conduct of this offering or the possession or distribution of this prospectus in any jurisdiction, other than the United States, where action for any such purpose would be required. Persons outside of the United States who come into possession of this prospectus must inform themselves about, and observe, any restrictions relating to the conduct of this offering and the possession and distribution of this prospectus that apply in the jurisdictions outside of the United States relevant to their circumstances.

Unless otherwise indicated or the context otherwise requires, all references in this prospectus to “Gelteq Limited,” “Gelteq,” “our company,” “the company” “we,” “us,” and “our” refer to Gelteq Limited and its consolidated subsidiaries.

Unless otherwise indicated or the context otherwise requires, all references in this prospectus to legislation are to federal, state and local legislation of the United States.

Unless otherwise indicated, references to a particular “fiscal year” are to our fiscal year ended June 30th of that year. Our fiscal quarters end on September 30th, December 31st, March 31st and June 30th of each fiscal year (for which purpose June 30th is also our fiscal year end). References to a year other than a “Fiscal” or “fiscal year” are to the calendar year ended December 31.

In this prospectus, all references to “Ordinary Shares” mean our Ordinary Shares, no par value.

In this prospectus, all references to the “Constitution” are to our new constitution as an Australian public company which became effective on May 26, 2022. Prior to May 26, 2022, the Company was a private company named Gelteq Pty Ltd, and on conversion to a public company on such date, the name of the Company changed to Gelteq Ltd. However, there has been no financial restructuring resulting upon the conversion of Gelteq Pty Ltd into a public company and Gelteq Limited is the same company as Gelteq Pty Ltd for financial, tax and other purposes.

This prospectus and the information incorporated herein by reference contain market data, industry statistics and other data that have been obtained from, or compiled from, information made available by third parties. We have not independently verified their data.

In this registration statement, any reference to any provision of any legislation shall include any amendment, modification, re-enactment or extension thereof. Words importing the singular shall include the plural and vice versa, and words importing the masculine gender shall include the feminine or neutral gender.

ii

MARKET AND INDUSTRY DATA

This prospectus contains estimates, projections, and other information concerning our industry and business, as well as data regarding market research, estimates, and forecasts prepared by our management. Information that is based on estimates, forecasts, projections, market research, or similar methodologies is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances that are assumed in this information. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section titled “Risk Factors.” Unless otherwise expressly stated, we obtained industry, business, market, and other data from reports, research surveys, studies, and similar data prepared by market research firms and other third parties, industry and general publications, government data, and similar sources. In some cases, we do not expressly refer to the sources from which this data is derived. In that regard, when we refer to one or more sources of this type of data in any paragraph, you should assume that other data of this type appearing in the same paragraph is derived from sources that we paid for, sponsored, or conducted, unless otherwise expressly stated or the context otherwise requires. While we have compiled, extracted, and reproduced industry data from these sources, we have not independently verified the data. Forecasts and other forward-looking information with respect to industry, business, market, and other data are subject to the same qualifications and additional uncertainties regarding the other forward-looking statements in this prospectus. See “Disclosure Regarding Forward-Looking Statements.”

iii

TRADEMARKS AND TRADE NAMES

We own or have rights to various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses. This prospectus also contains trademarks, service marks and trade names of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this prospectus is not intended to create, and does not imply, a relationship with us, or an endorsement or sponsorship by or of us. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear with the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, service marks and trade names.

iv

PRESENTATION OF FINANCIAL INFORMATION

The financial information contained in this prospectus derives from our audited consolidated financial statements in AUD$ as of June 30, 2024 and 2023 and for each of the two years then ended, and from our unaudited interim condensed consolidated financial statements in AUD$ as of December 31, 2024, and for the six months ended December 31, 2024 and 2023. These financial statements and related notes included elsewhere in this prospectus are in the form of Australian Dollar (AUD$) and are collectively referred to as our audited consolidated financial statements herein and throughout this prospectus. Our audited consolidated financial statements are prepared in accordance with International Financial Reporting Standards and International Accounting Standards as issued by the International Accounting Standards Board (IASB) and Interpretations (collectively IFRSs). Our fiscal year ends on June 30 of each year, so all references to a particular fiscal year are to the applicable year ended June 30. None of our financial statements were prepared in accordance with generally accepted accounting principles in the United States.

v

EXCHANGE RATES

Our reporting currency and functional currency is the Australian Dollar. We are not currently exposed for foreign currency risk. Foreign exchange risk arises from future commercial transactions and recognized financial assets and financial liabilities denominated in a currency that is not the entity’s functional currency. The risk is measured using sensitivity analysis and cash flow forecasting. Management understands, it will in the future, deal in foreign currencies and will have in place a risk management policy when it is required.

In this prospectus, unless otherwise stated, all references to “U.S. dollars”, “USD$,” are to the currency of the United States of America, and all references to “Australian Dollars,” “AUD$”, are to the currency of Australia. Our presentation currency of the financial statements was AUD$ and will remain AUD$. Any discrepancies in any table between totals and sums of the amounts listed are due to rounding. Certain amounts and percentages have been rounded; consequently, certain figures may add up to be more or less than the total amount and certain percentages may add up to be more or less than 100% due to rounding. In particular and without limitation, amounts expressed in millions contained in this prospectus have been rounded to a single decimal place for the convenience of readers.

All amounts set forth herein are presented in United States Dollars (USD$), unless otherwise specified, and have for presentation purposes have been converted from their AUD$ equivalent using the exchange rate of 1 AUD$ to 0.65 USD$.

vi

PROSPECTUS SUMMARY

The following summary highlights certain information about us, this offering and selected information contained elsewhere in this prospectus and is qualified in its entirety by, and should be read in conjunction with, the more detailed information and financial statements included elsewhere in this prospectus before making an investment decision. In addition to this summary, we urge you to read the entire prospectus carefully, especially the risks of investing in the Ordinary Shares, discussed under “Risk Factors,” before deciding whether to buy the Ordinary Shares.

Overview

We are a clinical and science-based company that is focused on developing and commercializing white label gel-based delivery solutions for prescription drugs, nutraceuticals, pet care and other products. A “white label” gel-based delivery solution is where we produce a product that other companies rebrand as their own product. Our principal products are edible gels, which we refer to as gels, and their application in gel-based dosage forms. Our current product suite consists of multiple products that sit within five core verticals — for pets, sports, pharmaceutical (pharma), over-the-counter (OTC) and nutraceutical — all of which leverage our patent pending multiple-ingredient dosage forms, and that we expect to have a wide range of applications and consumers. We currently focus our efforts on out-licensing our technology to companies to develop and create new products they can manufacture and sell within their established and researched markets, while we continue to manufacture our existing products under license (“white label”).

Recent Developments

On October 30, 2024, we consummated our initial public offering of 1,300,000 Ordinary Shares at a price of US$4.00 per share, generating gross proceeds to the Company of $5.2 million before deducting underwriting discounts and offering expenses. In connection with the IPO, the Company entered into an Underwriting Agreement, dated October 28, 2024 (the “Underwriting Agreement”) by and between the Company and The Benchmark Company, LLC as representative of the several underwriters. The Company agreed to an underwriting discount of 7.0% of the public offering price of the Ordinary Shares sold in the IPO.

On November 14, 2024, we entered into a license agreement for office space rental in New York for a fee of 4,468 USD per month. The license agreement has an initial term of six months and automatically renews for additional six-month terms upon the expiration of the initial term.

On December 2, 2024, we entered into an agreement with WPIC Marketing and Technologies Limited (“WPIC”) to assist with sales and distribution of our SportsGel products throughout the Asian Pacific region, commencing with China initially in March 2025. As of the date of this prospectus, we have four online stores across various platforms open in China as WPIC’s first region of focus.

On December 19, 2024, we appointed Dr. Paul Wynne as our Chief Scientific Officer.

On March 31, 2025, Simon H. Szewach resigned as our Executive Chairman. He continues to serve as our Chairman and Director.

On April 30, 2025, David A.V. Morton resigned as a Director.

On June 3, 2025, Anthony W. Panther resigned as our Chief Financial Officer and on the same day, Thuy-Linh Gigler became the Company’s Chief Financial Officer.

Lincoln Park Purchase Agreement

On March 13, 2025, we entered into the Purchase Agreement with Lincoln Park pursuant to which we have the right, but not the obligation, to sell to Lincoln Park up to $12,000,000 of Purchase Shares from time to time over the 24-month term beginning only after certain conditions set forth in the Purchase Agreement have been satisfied, including that this Registration Statement shall have been declared effective under the Securities Act, which we refer to as the Commencement Date. In accordance with the Purchase Agreement, on March 15, 2025, we issued 175,000 Ordinary Shares (the “Commitment Shares”) to Lincoln Park as consideration for its commitment to purchase our Ordinary Shares under the Purchase Agreement. On the business day immediately following the Commencement Date (the “Effective Purchase Date”), the Company has the option to sell to Lincoln Park under the Purchase Agreement an amount of Ordinary Shares equal to $50,000, at a price per share calculated on the same basis as a Regular Purchase (as defined below); provided, however, that such option will only be available on the Effective Purchase Date.

1

Although the Purchase Agreement provides that we may sell up to an aggregate of $12.0 million of our Ordinary Shares to Lincoln Park, only 4,000,000 Ordinary Shares are being registered for resale under this prospectus, which includes the 175,000 Commitment Shares that we already issued to Lincoln Park as a fee for making its irrevocable commitment to purchase our Ordinary Shares under the Purchase Agreement. Depending on the market prices of our Ordinary Shares at the time we elect to issue and sell our Ordinary Shares to Lincoln Park under the Purchase Agreement, we may need to register for resale under the Securities Act additional Ordinary Shares in order to receive aggregate gross proceeds equal to the $12.0 million total commitment available to us under the Purchase Agreement. If we elect to issue and sell to Lincoln Park under the Purchase Agreement more than the 3,825,000 Ordinary Shares being registered for resale by Lincoln Park under this prospectus, which we have the right, but not the obligation, to do, we must first register for resale under the Securities Act any such additional Ordinary Shares, which could cause additional substantial dilution to our shareholders. The number of Ordinary Shares ultimately offered for resale by Lincoln Park is dependent upon the number of Ordinary Shares we ultimately decide to sell to Lincoln Park under the Purchase Agreement.

To the extent that we are subject to the applicable rules of Nasdaq, in no event may we issue or sell to Lincoln Park under the Purchase Agreement our Ordinary Shares, including the Commitment Shares, in excess of 1,881,328 shares, which is equal to 19.99% of our Ordinary Shares outstanding immediately prior to the execution of the Purchase Agreement (the “Exchange Cap”) unless (i) we obtain shareholder approval to issue our Ordinary Shares in excess of the Exchange Cap or (ii) the average price of all Ordinary Shares issued to Lincoln Park under the Purchase Agreement equals or exceeds $1.29 per share (which represents the lower of (A) the official closing price of the Ordinary Shares on Nasdaq immediately preceding the signing of the Purchase Agreement and (B) the average official closing price of the Ordinary Shares on Nasdaq for the five consecutive trading days ending on the trading day immediately preceding the date of the Purchase Agreement), such that the transactions contemplated by the Purchase Agreement are exempt from the Exchange Cap limitation under applicable Nasdaq rules. In any event, the Purchase Agreement specifically provides that we may not issue or sell any Ordinary Shares under the Purchase Agreement if such issuance or sale would breach any applicable rules or regulations of Nasdaq or the Corporations Act 2001 (Commonwealth of Australia). The Purchase Agreement also prohibits us from directing Lincoln Park to purchase any of our Ordinary Shares if those shares, when aggregated with all other Ordinary Shares then beneficially owned by Lincoln Park (as calculated pursuant to Section 13(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Rule 13d-3 thereunder), would result in Lincoln Park and its affiliates beneficially owning more than 4.99% of the then total Ordinary Shares (which may be increased up to 9.99% of our Ordinary Shares), which we refer to herein as the Beneficial Ownership Limitation.

Lincoln Park Registration Rights Agreement

Concurrently with entering into the Purchase Agreement, we entered into a registration rights agreement with Lincoln Park (the “Registration Rights Agreement”) pursuant to which we agreed to register the resale of our Ordinary Shares that have been and may be issued to Lincoln Park under the Purchase Agreement pursuant to this Registration Statement.

Implications of Being an “Emerging Growth Company”

As a company with less than USD$1.235 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An “emerging growth company” may take advantage of reduced reporting requirements that are otherwise applicable to larger public companies. In particular, as an emerging growth company, we:

• may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations, or “MD&A”;

• are not required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those elements fit with our principles and objectives, which is commonly referred to as “compensation discussion and analysis”;

• are not required to obtain an attestation and report from our auditors on our management’s assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002;

2

• are not required to obtain a non-binding advisory vote from our shareholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on frequency” and “say-on-golden-parachute” votes);

• are exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and chief executive officer pay ratio disclosure;

• are eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act; and

• will not be required to conduct an evaluation of our internal control over financial reporting.

We intend to take advantage of all of these reduced reporting requirements and exemptions, with the exception of the longer phase-in periods for the adoption of new or revised financial accounting standards under §107 of the JOBS Act.

Under the JOBS Act, we may take advantage of the above-described reduced reporting requirements and exemptions until we no longer meet the definition of an emerging growth company. The JOBS Act provides that we would cease to be an “emerging growth company” at the end of the fiscal year in which the fifth anniversary of our initial sale of common equity pursuant to a registration statement declared effective under the Securities Act of 1933, as amended, herein referred to as the Securities Act, occurred, if we have more than USD$1.235 billion in annual revenues, have more than USD$700 million in market value of the Ordinary Shares held by non-affiliates, or issue more than USD$1 billion in principal amount of non-convertible debt over a three-year period.

Implications of Being a Foreign Private Issuer

We are a foreign private issuer within the meaning of the rules under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As such, we are exempt from certain provisions applicable to United States domestic public companies. For example:

• we are not required to provide as many Exchange Act reports, or as frequently, as a domestic public company;

• for interim reporting, we are permitted to comply solely with our home country requirements, which are less rigorous than the rules that apply to domestic public companies;

• we are not required to provide the same level of disclosure on certain issues, such as executive compensation;

• we are exempt from provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material information;

• we are not required to comply with the sections of the Exchange Act regulating the solicitation of proxies, consents, or authorizations in respect of a security registered under the Exchange Act; and

• we are not required to comply with Section 16 of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and establishing insider liability for profits realized from any “short-swing” trading transaction.

We will be required to file an annual report on Form 20-F within four months of the end of each fiscal year. In addition, we intend to publish our results on a quarterly basis as press releases, distributed pursuant to the rules and regulations of Nasdaq. Press releases relating to financial results and material events will also be furnished to the SEC on Form 6-K. However, the information we are required to file with or furnish to the SEC will be less extensive and less timely compared to that required to be filed with the SEC by U.S. domestic issuers. As a result, you may not be afforded the same protections or information that would be made available to you were you investing in a U.S. domestic issuer.

The Nasdaq listing rules provide that a foreign private issuer may follow the practices of its home country, which for us is Australia, rather than the Nasdaq rules as to certain corporate governance requirements, including the requirement that the issuer have a majority of independent directors and the audit committee, compensation committee and nominating and corporate governance committee requirements, the requirement to disclose third party director and

3

nominee compensation and the requirement to distribute annual and interim reports. A foreign private issuer that follows a home country practice in lieu of one or more of the listing rules shall disclose in its annual reports filed with the SEC each requirement that it does not follow and describe the home country practice followed by the issuer in lieu of such requirements. Although we do not currently intend to take advantage of these exceptions to Nasdaq corporate governance rules, we may in the future take advantage of one or more of these exemptions.

Corporate Information

Our registered office is located at Vistra Australia, Level 4, 100 Albert Road, South Melbourne VIC, 3025, Australia. Our principal place of business is located at Monash Innovation Labs, G. 60, 22 Alliance Lane, Clayton 3800, Victoria, Australia and our telephone number is +61 3 9087 3990. Our website address is http://www.gelteq.com. The information contained therein, or that can be accessed therefrom, is not and shall not be deemed to be incorporated into this prospectus or the registration statement of which it forms a part.

Corporate History and Structure

We were incorporated under the laws of the State of Victoria, Australia on October 15th, 2018. Our technology was assigned to us by our founders and a predecessor entity, who created it prior to the incorporation of our company. The intellectual property was then assigned to Gelteq at Gelteq’s inception to continue to build on this work.

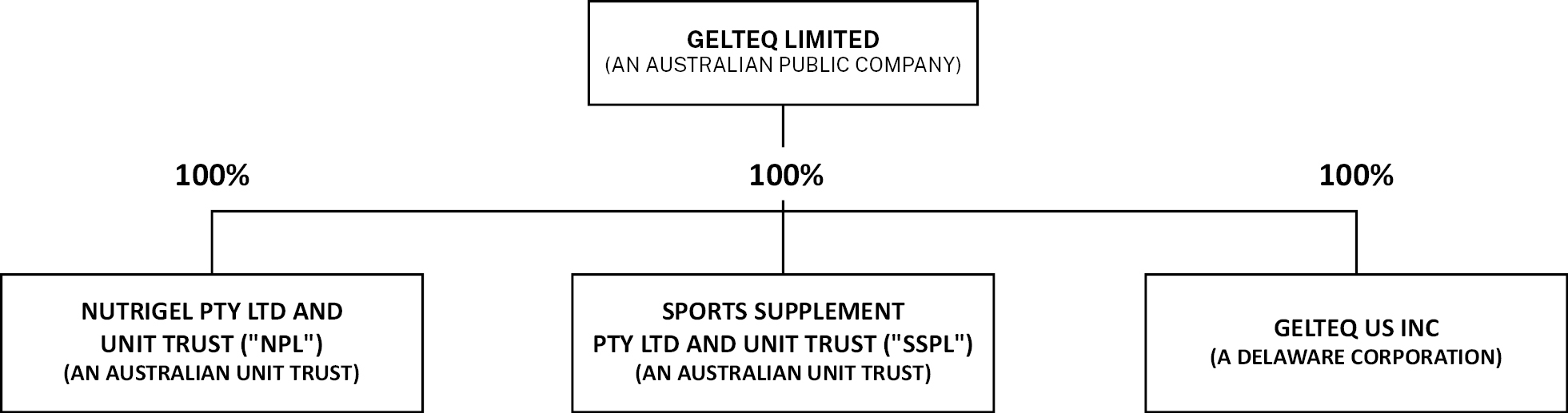

We currently have three direct, wholly-owned subsidiaries as part of our organizational structure: Nutrigel Pty Ltd and Unit Trust (“NPL”), Sport Supplements Pty Ltd and Unit Trust (“SSPL”) and Gelteq US Inc, a Delaware corporation.

The chart below summarizes our corporate structure, including our direct, wholly-owned subsidiaries, as of the date of this prospectus:

4

THE OFFERING

The summary below describes the principal terms of the offering of our Ordinary Shares. This summary is not complete and does not contain all the information you should consider before investing in our Ordinary Shares. You should carefully read this entire prospectus before investing in our Ordinary Shares including the sections “The Committed Equity Financing,” and “Risk Factors.”

|

Ordinary Shares Offered by the Selling Shareholder |

• up to 3,825,000 Ordinary Shares which we may sell to Lincoln Park from time to time over the next 24 months beginning on the Commencement Date, at our sole discretion, in accordance with the Purchase Agreement; and • 175,000 Ordinary Shares previously issued to Lincoln Park as consideration for its commitment to purchase our Ordinary Shares under the Purchase Agreement. We did not receive any cash proceeds from the issuance of these Commitment Shares. |

|

|

Ordinary Shares outstanding immediately after this offering(1) |

|

|

|

Nasdaq Listing |

Our Ordinary Shares currently traded on the Nasdaq Capital Market under the symbol “GELS.” |

|

|

Use of Proceeds |

We will receive no proceeds from the sale of the Ordinary Shares by Lincoln Park in this offering. However, we may receive up to $12,000,000 in aggregate gross proceeds under the Purchase Agreement from any sales of the Ordinary Shares from time to time after the date that the registration statement of which this prospectus is a part is declared effective and after satisfaction of other conditions in the Purchase Agreement. Depending on the market prices of our Ordinary Shares at the time we elect to issue and sell our Ordinary Shares to Lincoln Park under the Purchase Agreement, we may need to register for resale under the Securities Act additional Ordinary Shares in order to receive aggregate gross proceeds equal to the $12.0 million total commitment available to us under the Purchase Agreement. We currently intend to use any proceeds that we receive from the sale of Ordinary Shares to Lincoln Park under the Purchase Agreement for research and development, marketing activities and general working capital. |

|

|

Risk Factors |

See “Risk Factors” for a discussion of risks you should carefully consider before investing in the Ordinary Shares. |

____________

(1) The number of Ordinary Shares outstanding after this offering is based on the number of shares outstanding as of June 27, 2025, and excludes 91,000 of our Ordinary Shares issuable upon the exercise of underwriter’s warrants, issued to The Benchmark Company LLC as representative of the underwriters for our IPO, outstanding as of December 31, 2024 at an exercise price of $5.00 per Ordinary Share.

5

SUMMARY FINANCIAL DATA

The following tables set forth selected historical financial data for our business. The selected historical financial data (in AUD$) for our business is taken from our audited consolidated financial statements which have been prepared in accordance with International Financial Reporting Standards and International Accounting Standards as issued by the International Accounting Standards Board (IASB) and Interpretations (collectively IFRSs). Our historical results are not necessarily indicative of the results that may be expected in the future. You should read this data together with our audited consolidated financial statements and related notes appearing elsewhere in this prospectus as well as “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” appearing elsewhere in the prospectus.

We have derived the summary statements of loss and comprehensive loss data for the years ended June 30, 2024 and June 30, 2023 and for the six months ended December 31, 2024 and December 31, 2023, and the summary statement of financial position data as at June 30, 2024 and June 30, 2023, from our audited consolidated financial statements as at June 30, 2024 and as at June 30, 2023, and for the two years then ended, and unaudited condensed consolidated financial statements as at December 31, 2024, and for the six months ended December 31, 2024 and 2023, included elsewhere in this prospectus.

Summary Statement of Consolidated Profit or Loss:

|

For the year ended |

For the six months ended |

|||||||||||

|

2024 |

2023 |

2024 |

2023 |

|||||||||

|

Revenue |

|

|

|

|

||||||||

|

Revenue from contracts with customers |

— |

|

79,843 |

|

— |

|

— |

|

||||

|

Gains from loan modifications |

— |

|

222,681 |

|

— |

|

— |

|

||||

|

Other income |

146,884 |

|

317,888 |

|

311,412 |

|

76,879 |

|

||||

|

Expenses |

|

|

|

|

||||||||

|

Raw materials and consumable expenses |

— |

|

(48,925 |

) |

— |

|

— |

|

||||

|

Advertising & marketing expense |

(18,200 |

) |

(166,929 |

) |

(118,211 |

) |

(18,200 |

) |

||||

|

Consulting fees |

(750 |

) |

(80,407 |

) |

(409,134 |

) |

(750 |

) |

||||

|

Depreciation and amortization expenses |

(1,211,896 |

) |

(1,226,491 |

) |

(606,497 |

) |

(609,274 |

) |

||||

|

Employee benefit expense |

(875,579 |

) |

(752,584 |

) |

(248,655 |

) |

(519,687 |

) |

||||

|

Finance costs |

(600,220 |

) |

(404,069 |

) |

(620,785 |

) |

(286,791 |

) |

||||

|

IPO related expenses |

(166,084 |

) |

(278,319 |

) |

(637,594 |

) |

(102,941 |

) |

||||

|

Legal Fees |

— |

|

(5,270 |

) |

— |

|

— |

|

||||

|

Research expense |

(276,057 |

) |

(665,035 |

) |

(314,472 |

) |

(100,934 |

) |

||||

|

Share based expense |

— |

|

— |

|

— |

|

— |

|

||||

|

Other expenses |

(145,851 |

) |

(69,681 |

) |

(203,680 |

) |

(25,527 |

) |

||||

|

Corporate expenses |

(222,641 |

) |

(428,922 |

) |

(456,743 |

) |

(98,419 |

) |

||||

|

Inventory Write Off |

(175,081 |

) |

— |

|

— |

|

— |

|

||||

|

Intellectual Property Services |

— |

|

— |

|

— |

|

— |

|

||||

|

(Loss) before income tax |

(3,546,195 |

) |

(3,506,220 |

) |

(3,304,359 |

) |

(1,685,644 |

) |

||||

|

Tax income/(expense) |

|

|

— |

|

— |

|

||||||

|

(Loss) after income tax |

(3,546,195 |

) |

(3,506,220 |

) |

(3,304,359 |

) |

(1,685,644 |

) |

||||

|

Weighted average number of Ordinary Shares – basic and diluted |

7,940,026 |

|

7,940,026 |

|

8,620,569 |

|

8,118,075 |

|

||||

|

Loss per share attributable to owners of the company – basic and diluted |

(0.44 |

) |

(0.44 |

) |

(0.38 |

) |

(0.21 |

) |

||||

6

Summary Statement of Consolidated Comprehensive Income:

|

For the year ended |

For the six months ended |

|||||||||||

|

2024 |

2023 |

2024 |

2023 |

|||||||||

|

(Loss) |

(3,546,195 |

) |

(3,506,220 |

) |

(3,304,359 |

) |

(1,685,644 |

) |

||||

|

Other comprehensive income |

|

|

|

|

||||||||

|

Total other comprehensive income |

— |

|

— |

|

— |

|

— |

|

||||

|

Total comprehensive (expense) |

(3,546,195 |

) |

(3,506,220 |

) |

(3,304,359 |

) |

(1,685,644 |

) |

||||

|

Total comprehensive (expense) attributable to members of the company |

(3,546,195 |

) |

(3,506,220 |

) |

(3,304,359 |

) |

(1,685,644 |

) |

||||

Summary Statement of Financial Position Data:

|

As at |

As at |

As at |

As at |

|||||||||

|

ASSETS |

|

|

|

|

||||||||

|

Current Assets |

|

|

|

|

||||||||

|

Cash and cash equivalents |

24,522 |

|

399,224 |

|

3,046,602 |

|

24,522 |

|

||||

|

Trade and other receivables |

183,004 |

|

345,291 |

|

305,007 |

|

183,004 |

|

||||

|

Inventories |

— |

|

95,201 |

|

— |

|

— |

|

||||

|

Prepayments and other assets |

95,700 |

|

151,258 |

|

1,587,521 |

|

95,700 |

|

||||

|

Total Current Assets |

303,227 |

|

990,974 |

|

4,939,130 |

|

303,227 |

|

||||

|

|

|

|

|

|||||||||

|

Non-Current Assets |

|

|

|

|

||||||||

|

Plant and equipment |

16,642 |

|

— |

|

18,056 |

|

16,642 |

|

||||

|

Right-of-use assets |

— |

|

10,001 |

|

— |

|

— |

|

||||

|

Intangible Assets |

20,437,958 |

|

21,493,661 |

|

20,158,270 |

|

20,437,958 |

|

||||

|

Total Non-Current Assets |

20,454,600 |

|

21,503,662 |

|

20,176,326 |

|

20,454,600 |

|

||||

|

Total Assets |

20,757,827 |

|

22,494,636 |

|

25,115,456 |

|

20,757,827 |

|

||||

|

|

|

|

|

|||||||||

|

LIABILITIES |

|

|

|

|

||||||||

|

Current Liabilities |

|

|

|

|

||||||||

|

Trade and other payables |

1,558,186 |

|

1,184,404 |

|

892,791 |

|

1,558,186 |

|

||||

|

Deferred Revenue |

125,359 |

|

85,359 |

|

118,704 |

|

125,359 |

|

||||

|

Borrowings, net |

2,084,152 |

|

5,086 |

|

3,882,778 |

|

2,084,152 |

|

||||

|

Derivative liability |

— |

|

— |

|

1,279,184 |

|

— |

|

||||

|

Lease liabilities |

— |

|

11,896 |

|

— |

|

— |

|

||||

|

Employee benefit provisions |

98,368 |

|

77,780 |

|

105,198 |

|

98,368 |

|

||||

|

Total Current Liabilities |

3,866,065 |

|

1,364,525 |

|

6,278,655 |

|

3,866,065 |

|

||||

|

|

|

|

|

|||||||||

|

Non-Current Liabilities |

|

|

|

|

||||||||

|

Borrowings |

1,759,447 |

|

2,471,619 |

|

13,550 |

|

1,759,447 |

|

||||

|

Lease liabilities |

— |

|

— |

|

|

|

— |

|

||||

|

Employee benefit provisions |

20,018 |

|

— |

|

29,488 |

|

20,018 |

|

||||

|

Total Non-Current Liabilities |

1,779,465 |

|

2,471,619 |

|

43,038 |

|

1,779,465 |

|

||||

|

Total Liabilities |

5,645,530 |

|

3,836,144 |

|

6,321,693 |

|

5,645,530 |

|

||||

|

Net Assets |

15,112,297 |

|

18,658,492 |

|

18,793,763 |

|

15,112,297 |

|

||||

|

|

|

|

|

|||||||||

|

EQUITY |

|

|

|

|

||||||||

|

Issued capital |

26,608,227 |

|

26,608,227 |

|

33,594,052 |

|

26,608,227 |

|

||||

|

Reserves |

|

|

— |

|

|

|

|

|

||||

|

Accumulated losses |

(11,495,930 |

) |

(7,949,735 |

) |

(14,800,289 |

) |

(11,495,930 |

) |

||||

|

Total Equity (Deficit) |

15,112,297 |

|

18,658,492 |

|

18,793,763 |

|

15,112,297 |

|

||||

7

RISK FACTORS

An investment in the Ordinary Shares involves a high degree of risk. Before deciding whether to invest in the Ordinary Shares, you should consider carefully the risks described below, and in “Item 3. Key Information — D. Risk factors” in our Annual Report on Form 20-F for the year ended June 30, 2024, incorporated by reference herein, together with all of the other information set forth in this prospectus, including the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operation” and our consolidated financial statements and related notes. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be materially and adversely affected, which could cause the trading price of the Ordinary Shares to decline, resulting in a loss of all or part of your investment. Further, if we fail to meet the expectations of the public market in any given period, the market price of the Ordinary Shares could decline. Our business involves significant risks and uncertainties, some of which are outside of our control. If any of these risks actually occurs, our business and financial condition could suffer and the price of the Ordinary Shares could decline. The risks described below are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may also affect our business. You should only consider investing in the Ordinary Shares if you can bear the risk of loss of your entire investment.

Risks Related to Our Business and Industry

We have a history of operating losses and may not achieve or sustain profitability in the future

We have incurred operating losses since our inception and expect to continue to incur operating losses for the foreseeable future. We have recently commenced marketing our products and cannot be sure we will be able to continue to increase our sales to achieve profitability. Our ability to achieve profitability depends on a number of factors, including our ability to successfully market our existing products, directly or through partners, continue to develop new products, obtain regulatory approval for our products, as necessary and consummate partnership and licensing agreements.

We expect to continue to incur losses for the foreseeable future, and these losses will likely increase as we:

• develop new products;

• complete testing of products that we have created;

• clinical trials can offer take longer than expected and be more costly than originally budgeted for;

• negotiate partnerships and licensing arrangements with respect our products;

• implement internal systems and infrastructures;

• hire management and other personnel; and

• ramp up our sales and marketing infrastructure and operations to drive sales of our products.

If we are unsuccessful in developing products or if our products do not achieve market acceptance, we may never become profitable. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis. Our inability to achieve and then maintain profitability would negatively affect our business, financial condition, results of operations and cash flows. Moreover, our prospects must be considered in light of the risks and uncertainties encountered by an early-stage company and in highly regulated and competitive markets, such as the drug delivery market, where regulatory approval and market acceptance of our products are uncertain. There can be no assurance that our efforts will ultimately be successful or result in revenues or profits.

We will require substantial additional financing to achieve our goals, and a failure to obtain this necessary capital when needed could force us to delay, limit, reduce or terminate our product development or commercialization efforts.

We incurred total losses in the past of approximately AUD$3,546,195 and AUD$3,506,220 in the fiscal years ended June 30, 2024 and 2023 respectively and approximately AUD$ 3,304,359 and AUD$ 1,685,644 for the six months ended December 31, 2024 and 2023 respectively. Our ability to achieve and sustain profitability in the future depends in part on the rate of growth of, and changes in technology trends in, our market; the global economy; our ability to develop new products and technologies in a timely manner; the competitive position of our products; our ability to

8

manage our operating expenses; and other factors and risks, some of which are described in this prospectus. We may also seek to increase our operating expenses and make additional expenditures in anticipation of generating higher revenues, which we may not realize, if at all, until sometime in the future. As such, there can be no assurance that we will be able to achieve or sustain profitable operations in the future.

We have expended and believe that, subject to receiving adequate financing and/or entering into a collaboration agreement, we will continue to expend significant operating and capital expenditures for the foreseeable future developing, establishing licensing and partnership arrangement and marketing our products. These expenditures will include, but are not limited to, costs associated with research and development, manufacturing, conducting studies of new products and product applications, contracting with research organizations, obtaining and retaining development, sales and marketing partnerships and hiring additional management and other personnel. We cannot reasonably estimate the actual amounts necessary to successfully complete the research, development and commercialization of our products and any other future product. In addition, other unanticipated costs may arise. As a result of these and other factors currently unknown to us, we will require additional funds, through public or private equity or debt financings or other sources, such as strategic partnerships and alliances and licensing arrangements. In addition, we may seek additional capital due to favorable market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans. A failure to fund these activities may harm our growth strategy, competitive position, quality compliance and financial condition.

Our future capital requirements depend on many factors, including:

• the scope, progress, results and costs of researching and developing our products;

• the cost of manufacturing our products;

• our ability to establish and maintain strategic partnerships, licensing, supply or other arrangements and the financial terms of such agreements;

• the costs involved in preparing, filing, prosecuting, maintaining, defending and enforcing patent claims, including litigation costs and the outcome of such litigation;

• the expenses needed to attract and retain skilled personnel; and

• any product liability or other lawsuits related to existing and/or any future products.

Additional funds may not be available when we need them, on terms that are acceptable to us, or at all. If adequate funds are not available to us on a timely basis, we may be required to delay, limit, reduce or terminate research and development activities for our products or delay, limit, reduce or terminate our establishment of sales and marketing capabilities or other activities that may be necessary to commercialize our products.

Our operating results may fluctuate, as we have created a new class of products for which demand is unknown, which makes our results difficult to predict and could cause our results to fall short of our expectations.

Our principal products are edible gels, which we refer to as gels, and their application in gel-based dosage forms. While other companies manufacture and sell edible gels, we believe we are the first company to market edible gels in many of the verticals industries we are targeting. Going forward, our operating results may fluctuate as a result of a number of factors, including, without limitation, the costs associated with raw materials, manufacturing costs and expenses and the costs incurred in our marketing and distribution and sales network, many of which are outside of our control. As a result, comparing our operating results on a period-to-period basis may not be meaningful, and you should not rely on our past results as an indication of our future performance. Our interim, year-to-date, and annual expenses as a percentage of our revenues may differ significantly over time. Our operating results in future quarters may fall below expectations.

Because our business is changing and evolving, our historical and current operating results may not be useful to you in predicting our future operating results.

9

Fluctuations in the prices of raw materials can increase the cost of our products, impact our ability to meet production commitments, and may adversely affect our results of operations.

The cost of raw materials is a key element in the cost of our gels. Our inability to offset material price inflation through increased prices to customers and suppliers, or through productivity actions could adversely affect our results of operations. Many major components, product equipment items, and raw materials are procured or subcontracted, which may negatively affect the availability and price of essential aspects of our products. Our inability to fill our supply needs would jeopardize our ability to fulfill obligations under our contracts, which could, in turn, result in reduced sales and profits, contract penalties or terminations, and damage to our customer and distributor relationships. The cost of raw materials that are applied to manufacture our products has been impacted and is expected to continue to be impacted by the risks we may face arising from the Russian invasion of Ukraine.

Our customers have a history of delaying orders which may adversely affect our revenues and income.

We have received several orders from customers who subsequently advised us of cash flow difficulties and their inability to pay for such orders in a timely manner. This has limited our ability to generate the expected revenue off these orders in a timely manner. However, as of the date of this prospectus. such customers that experienced cash flow difficulties had not cancelled their orders and we have manufactured such orders and shipped them in the fiscal year ending June 30, 2025. We have put in place more rigorous qualification procedures to ensure customers have the financial ability to pay for its orders. However, we cannot guarantee that our customers will present their accurate business status to us and pay for their orders in a timely order, which may adversely affect our revenues and income.

There is substantial doubt about our ability to continue as a going concern.

Our audited financial statements for the years ended June 30, 2024 and 2023, and our unaudited financial statements for the six months ended December 31, 2024, were prepared assuming that we will continue as a going concern. In addition, as discussed in Note 4 of the financial statements for the years ended June 30, 2024 and 2023, and the six months ended December 31, 2024, the Company was in a current liability position as of December 31, 2024, June 30, 2024 and 2023, and has suffered recurring losses from operations. These conditions raise substantial doubt on our ability to continue as a going concern. The report of our independent registered public accounting firms on the financial statements for the year ended June 30, 2024 and 2023 both included an explanatory paragraph on the doubt of our ability to continue as a going concern.

As discussed in Note 4 of the financial statements for the years ended June 30, 2024 and 2023, and for the six months ended December 31, 2024, our ability to continue as a going concern will be dependent upon our management’s plans and execution, which includes raising additional capital, either through the proposed offering or raising funds through private markets or the issue of additional Convertible Notes, obtaining regulatory approvals for our products and generating revenues from these products and reducing expenditure accordingly if required, in order to be able to pay its debts as and when they fall due. If we fail to obtain regulatory approval for our products or fail to raise additional capital in debt or equity financing on terms favorable to us, then we may be unable to achieve our objectives. Further, subsequent to the Company’s board of directors signing of the June 30, 2023 and 2022 financial statements in December 2023, the shareholder loans, issued on January 20, 2022 collectively have maturity dates of December 31, 2025 and such loans will become due within 12 months from December 31, 2024. As such, our ability to continue as a going concern is also dependent on our management’s ability to either extend the maturity date of such shareholder loans or have the shareholders elect to convert such loans into equity.

Our business and our ability to raise capital may be materially adversely affected by global geopolitical conditions resulting from the ongoing Russia-Ukraine conflict, the Israel-Hamas conflict and recent actions undertaken by the United States, such as the imposition of tariffs and the response of China and other nations thereto.

Global markets are experiencing volatility and disruption as a result of the geopolitical instability resulting from the ongoing Russia-Ukraine conflict, the Israel-Hamas conflict and recent actions undertaken by the United States, such as the imposition of tariffs and the response of China and other nations thereto. The invasion of Ukraine by Russia, the Israel-Hamas conflict, recent actions undertaken and threatened by the United States and the resulting measures that have been taken, and could be taken in the future, by China, NATO, the United States, the United Kingdom, the European Union, Israel and other countries have created global security concerns that could have a lasting impact on regional and global economies and financial markets. Although the length and impact of the ongoing conflicts

10

are highly unpredictable, they could lead to market disruptions, including significant volatility in commodity prices, credit and capital markets, as well as supply chain interruptions. Additionally, any resulting sanctions could adversely affect the global economy and financial markets and lead to instability and lack of liquidity in capital markets. The uncertainty regarding the imposition of tariffs could cause large variations in shipping costs and timelines, higher import costs and costs of goods as well as increased uncertainty around customs clearance timelines and costs.

Any of the abovementioned factors, or any other negative impact on the global economy, capital markets or other geopolitical conditions resulting from such actions, could adversely affect our business or disrupt the capital markets, impacting our ability to raise capital. The extent and duration of the ongoing conflicts, resulting sanctions and any related market disruptions are impossible to predict, but could be substantial, particularly if current or new sanctions continue for an extended period of time or if geopolitical tensions result in expanded military operations on a global scale. Additionally, the uncertainty on tariffs increases the risk that we may not be able to hedge our pricing nor derive the margins we plan to achieve. Any such disruptions may also have the effect of heightening many of the other risks described in this section. If these disruptions or other matters of global concern continue for an extensive period of time, our business may be materially adversely affected.

If the market for our gels does not develop or become sustainable, expands more slowly than we expect, or becomes saturated, our revenues may fail to materialize, and our financial condition and results of operations could be materially and adversely affected.

The market for our products is new and rapidly evolving, and we may face an unexpected number of competitors. We believe that our innovative gel products are addressing a market that did not exist previously and there is no assurance that the gel industry will develop as envisioned by us, or that, if it does develop, we will succeed in executing our business plan, or acquiring any meaningful market share. Our success is highly dependent on the market’s acceptance of our technology and our products, and on our leadership of any market that materializes. If the market for our products does not materialize, become sustainable, or becomes saturated with competing products or services, our revenues may not materialize, or may be lower than projections, and our financial condition and results of operations could be materially and adversely affected. Should lower than expected sales occur, we intend to adjust our expenses to align with the revenue generated to ensure we remain financially solvent and as a going concern.

Our success depends on our ability to obtain market acceptance for our products and services.

Our future success and the planned growth and expansion of our business depend on us achieving broad acceptance of our products and growing our customer base. This depends, in part, on our technology, our ability to respond to consumer preferences, our marketing plans, our ability to locate and enter into agreements with partners and adoption of our products. If we are unable to obtain customer acceptance, to effectively market our products directly or through partners, our business and results of operations will be materially impaired.

The loss of the services of our key personnel would negatively affect our business.

Our future success depends to a large extent on the continued services of our senior management and key personnel, including, in particular, our Chief Executive Officer, Nathan J. Givoni. Any loss of the services of our key personnel, and especially that of Mr. Givoni, would adversely affect our business. We have attempted to mitigate this situation by ensuring that Mr. Givoni provides us long notice periods and has extra share compensation via the employee stock option plan to encourage his long term tenure and performance with the Company. The employment agreements entered into with Mr. Givoni stipulates that he must give six months written notice of his intent to resign, allowing the Company time to find a suitable replacement.

Although our Ordinary Shares began trading on The Nasdaq Stock Market LLC on October 28, 2024, we do not know whether an active, liquid trading market for our Ordinary Shares will be sustained or what the trading price of our Ordinary Shares will be in the future. Our Ordinary Shares may trade at a price below the price you paid and may be difficult for you to sell the Ordinary Shares you purchase.

Although our Ordinary Shares are listed on Nasdaq and began trading on October 28, 2024, an active trading market for our Ordinary Shares may not be sustained. It may be difficult for you to sell your Ordinary Shares without depressing the market price for the Ordinary Shares or at all. Consequently, you may not be able to sell your Ordinary Shares at

11

or above the price you paid, or at all. Further, an inactive market may also impair our ability to raise capital by selling Ordinary Shares and it also may impair our ability to enter into strategic partnerships or acquire companies, products, or services by using our equity securities as consideration.

We cannot predict the extent to which investor interest in us will sustain an active trading market or how active and liquid that market may become in the future. If an active and liquid trading market does not continue, you may have difficulty selling your Ordinary Shares at an attractive price or at all. The market price of our Ordinary Shares may decline below the price you paid and you may not be able to sell your Ordinary Shares at or above the price you paid, or at all.

The market price of our Ordinary Shares has been and may continue to be highly volatile, and you could lose all or part of your investment.

In addition, the market price of our Ordinary Shares could fluctuate significantly as a result of a number of factors, including:

• fluctuations in our financial performance;

• economic and stock market conditions generally and specifically as they may impact us, participants in our industry or comparable companies;

• changes in financial estimates and recommendations by securities analysts following our Ordinary Shares or comparable companies;

• earnings and other announcements by, and changes in market evaluations of, us, participants in our industry or comparable companies;

• our ability to meet or exceed any future earnings guidance we may issue;

• changes in business or regulatory conditions affecting us, participants in our industry or comparable companies;

• changes in accounting standards, policies, guidance, interpretations or principles;

• announcements or implementation by our competitors or us of acquisitions, technological innovations, or other strategic actions by our competitors; or

• trading volume of our Ordinary Shares or sales of shares by our management team, directors or principal shareholders.

These and other factors could limit or prevent investors from readily selling their Ordinary Shares or otherwise negatively affect the liquidity of our Ordinary Shares, and you could lose all or part of your investment.

The market price of our Ordinary Shares could be adversely affected by future sales, including sales by the selling shareholder named herein and distributions of our Ordinary Shares or the perception that such sales, including sales by the selling shareholder named herein.

Sales, by the selling shareholder named herein, distributions or issuances of a substantial number of our Ordinary Shares following this offering or the perception that such sales or distributions might occur, could cause a decline in the market price of our Ordinary Shares or could impair our ability to obtain capital through a subsequent offering of our equity securities or securities convertible into equity securities.

We may issue additional securities in the future, including Ordinary Shares, and options, rights, warrants and other convertible securities for any purpose and for such consideration and on such terms and conditions we may determine appropriate or necessary, including in connection with equity awards, financings or other strategic transactions. Subject to the requirements of the Corporations Act, our board of directors will be able to determine the class, designations, preferences, rights and powers of any additional shares, including any rights to share in our profits, losses and dividends or other distributions, any rights to receive assets upon our dissolution or liquidation and any redemption, conversion and exchange rights.

12

Future sales of a substantial number of our Ordinary Shares by our existing shareholders in addition to the shares offered by this prospectus could cause our stock price to decline.

As of June 27, 2025, there were 10,028,025 of our Ordinary Shares outstanding. All of the Ordinary Shares sold in the IPO became eligible for sale immediately upon issuance in the IPO. Additional shares will be eligible for sale in the public market upon expiration of the remaining unexpired lock-up agreements entered into in connection with the IPO. Subject to any applicable lock-up agreements, pursuant to Rule 144 under the Securities Act as in effect on the date hereof, or Rule 144, a person who holds restricted Ordinary Shares (assuming there are any restricted shares) and is not one of our affiliates at any time during the three months preceding a sale, and who has beneficially owned these restricted shares for at least six months, would be entitled to sell an unlimited number of Ordinary Shares, provided current public information about us is available. In addition, under Rule 144, a person who holds restricted shares in us and is not one of our affiliates at any time during the three months preceding a sale, and who has beneficially owned these restricted shares for at least one year, would be entitled to sell an unlimited number of shares without regard to whether current public information about us is available. It is conceivable that following the holding period, many shareholders may wish to sell some or all of their shares. If our shareholders sell substantial amounts of our Ordinary Shares in the public market at the same time, the market price of our Ordinary Shares could decrease significantly due to an imbalance in the supply and demand of our Ordinary Shares. Even if they do not actually sell the Ordinary Shares, the perception in the public market that our shareholders might sell significant Ordinary Shares could also depress the market price of our Ordinary Shares.

If securities or industry analysts do not publish or cease publishing research or reports about us, our business or our market, or if they publish negative reports regarding our business or our securities, our share price and trading volume could decline.

The trading market for the Ordinary Shares will be influenced by the research and reports that industry or securities analysts may publish about us, our business, our market or our competitors. We do not have any control over these analysts and we cannot provide any assurance that analysts will cover us or provide favorable coverage. If any of the analysts who may cover us adversely change their recommendation regarding the Ordinary Shares, or provide more favorable relative recommendations about our competitors, the price of our Ordinary Shares would likely decline. If any analyst who may cover us were to cease coverage of our Company or fail to regularly publish reports on us, we could lose visibility in the financial markets, which in turn could cause the price of our Ordinary Shares or trading volume to decline.

Management has broad discretion as to the use of proceeds we may receive from the sale of Purchase Shares to Lincoln Park.

Our management has broad discretion in the allocation of proceeds we may receive from the sale of Purchase Shares to Lincoln Park and could use such proceeds for purposes other than those contemplated at the date of this prospectus. Our shareholders may not agree with the manner in which our management chooses to allocate and spend such proceeds.

We may need additional capital beyond the capital raised from the sale of Purchase Shares to Lincoln Park, and the sale of additional Ordinary Shares or equity or debt securities could result in additional dilution to our shareholders.

Although the net proceeds from our IPO and the sale of Purchase Shares to Lincoln Park are anticipated to be sufficient for research and development, marketing activities and general working capital purposes, further funding may be required. We may need to raise additional capital beyond the capital raised in the IPO and from the sale of Purchase Shares to Lincoln Park in order to support additional growth opportunities or to provide additional cash flow should our sales not be achieved as forecasted. Such additional capital may be raised through a combination of private and public equity offerings, debt financings and collaborations, and strategic and licensing arrangements. To the extent that we raise additional capital through the issuance of equity or convertible debt securities, your ownership interest will be diluted, and the terms may include liquidation or other preferences that adversely affect your rights as a holder of our Ordinary Shares. Debt financing, if available, may involve agreements that include covenants limiting or restricting our ability to take certain actions, such as incurring debt, without prior approval, making capital expenditures or declaring dividends. If we raise additional funds through strategic partnerships and alliances and licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies or product or grant licenses on terms that

13

are not favorable to us. If we are unable to raise additional funds through equity or debt financing when needed, we may be required to delay, limit, reduce or terminate our product development, sales launch or marketing efforts or grant rights to develop and market product that we would otherwise prefer to develop and market ourselves.

The terms of the Purchase Agreement limit the amount of Ordinary Shares we may issue to Lincoln Park, which may limit our ability to utilize the arrangement to enhance our cash resources.

The Purchase Agreement includes restrictions on our ability to sell Ordinary Shares to Lincoln Park, including, subject to specified limitations, if a sale would cause Lincoln Park and its affiliates to exceed the Beneficial Ownership Limitation.

Accordingly, we cannot guarantee that we will be able to sell all 3,825,000 Purchase Shares in this offering. If we cannot sell the full amount of Ordinary Shares that Lincoln Park has committed to purchase because of these limitations, we may be required to utilize more costly and time-consuming means of accessing the capital markets, which could materially adversely affect our liquidity and cash position. If we choose to sell more Ordinary Shares than are offered under this prospectus, we must first register for resale under the Securities Act such additional Ordinary Shares.

If we fail to develop or maintain an effective system of disclosure controls and internal control over financial reporting in compliance with the requirements that will be applicable to us as a public company in the United States, our ability to produce timely and accurate consolidated financial statements or comply with applicable regulations could be impaired and our listing on Nasdaq Capital Market could be terminated.